This is the terrifying reason Scotland’s major banks are preparing to quit Scotland if there is a yes vote

Lloyds Banking Group and Royal Bank of Scotland (RBS) have both confirmed their intention to re-domicile to England in the event of a break-up of the U.K., while Standard Life reiterated it was also looking at transferring its business south of the border. Why?

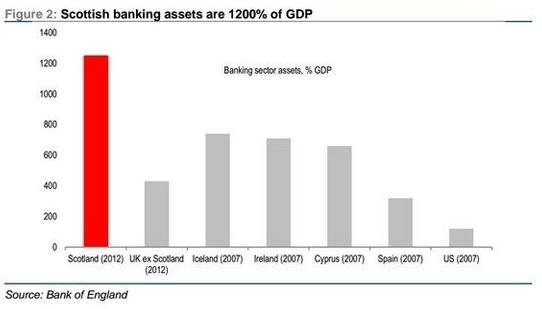

The main problem is that the size of the banking industry would dwarf the resources of an independent Scotland. Scottish banks have assets totaling around 1254% of the country’s GDP — even worse than Iceland (880% of GDP) in 2007 before its banking crash.

On Wednesday, Bank of England Governor Mark Carney warned that an independent Scotland would require £130 billion in cash (or cash equivalent) reserves in order to guarantee bank deposits and provide the country’s banks with a credible lender of last resort. This would be equivalent to 100% of GDP.

Financial services contributed £8.8 billion to the Scottish economy in 2010, or 1/8th of the country’s total economic total activity, while one in seven Scots are employed either directly or indirectly by the sector.

Posted in: Infographic of the day