Our Guardian Masterclass on February 12 will teach you how to win a pitch when you can only pitch online

Why stop at Trump? Twitter must ban world leaders FOREVER

It’s striking how much less noise there is in U.S. politics — even during an extraordinarily turbulent time — without Trump’s constant flow of unhinged tweets, Brian Klaas, a professor of global politics at University College London, tweeted this month.

And misinformation about election fraud plummeted after Trump was kicked off, one research has firm found.

Since Trump has stopped live tweeting all day, citizens have enjoyed cognitive space to better understand what’s actually happening around us.

Experts suggests we should learn from this: Heads of state should not be allowed to tweet.

It can’t be right that the most powerful person in the world’s most visible lever on power are 280-character chunks of tossed-off thoughts published instantly, without review, on a medium run by a private company whose secret algorithms are designed to encourage outrage.

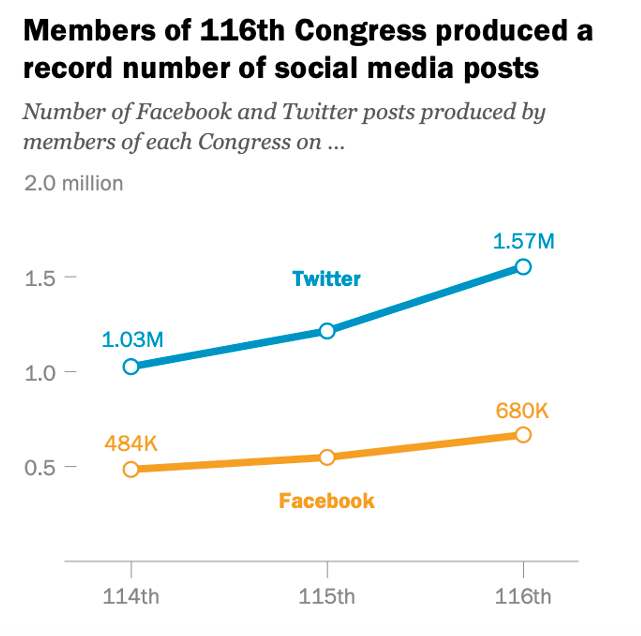

And it is insane that The Pew Research Center discovered that while the 116th Congress barely passed any substantive bills, its members collectively set records for their activity on Twitter.

Lawmaking, now, is more a matter of going viral than getting anything done.

That’s a trend we need to end. Twitter is better without Trump. But why stop there. Let’s keep kicking off more politicians, so they can get on with the day job.

Posted in: Infographic of the day | Leave a CommentIt’s time to tax social media LIKE CIGARETTES

Tech executives are among those who have gotten significantly richer during the pandemic — not because of some new inventions but because their services filled voids created by the dire circumstances.

Putting Saudi Aramco aside, the top five most valuable companies in the world right now are tech giants: Apple, $2.41 trillion; Microsoft, $1.76 trillion; Amazon, $1.67 trillion; Alphabet/Google, $1.3 trillion; and Facebook, $803.4 billion.

Having profited so much for the pandemic, it stands to reason that some of these firms should help America get back on its feet. One idea floated by Yale professor Daniel Markovits suggests a five percent tax on the richest five percent of households which he calculates could raise up to $2 trillion.

Another idea from Silicon Valley insiders is to tax social media. The idea is to make firms such as Twitter and Facebook pay for the repercussions of the toxic waste that flows over their platforms.

Society is happy to tax addictive and harmful products such as sugary drinks and cigarettes, the argument goes, so why not tax social media, which also makes society sick by pumping out the poison.

Social media platforms clearly cannot self-regulate and getting the right laws in place will take forever the US government should tax them without delay.

Rage fostered online has a societal cost, and those responsible should pay for it.

Failing video game retailer GameStop’s stock was up 1700%. Then it dropped 75% in 90 minutes. WHAT IS GOING ON?

Tesla’s stock is way up. BlackBerry’s shares are up nearly 280 percent this year. Stock in AMC, the movie theatre chain, has surged nearly 840 percent.

But that is nothing compared to GameStop, a troubled video game retailer that was once a fixture in suburban malls.

GameStop’s market value increased to over $24 billion from $2 billion in a matter of days.

Its shares have risen over 1,700 percent since December. Between Tuesday and Wednesday, the market value rose over $10 billion.

Then, overnight, the value of Gamestop stock dropped by three quarters. Then by the end of the week, bounce up again. What on earth is going on?

Individual investors often derided as “dumb money,”— many of them followers of a popular, juvenile, foul-mouthed Reddit page called Wall Street Bets — banded together to put the squeeze on Wall Street hedge funds that had bet GameStop’s shares would fall.

In Wall Street parlance, this is a “short squeeze” — a strategy sometimes employed by sophisticated investors against one another. Hedge funds attempting to short GameStop have lost more than $5 billion of the squeeze. his week, Tesla’s chief executive and world’s richest man, Elon Musk, fuelled the frenzy in trading GameStop Options by posting about the Reddit page on Twitter.

In many cases private investors – trading on commission-free App Robinhood – were trading on margin. That means they were using funds borrowed from their broker Robinhood. As trading volumes rose this week, Robinhood faced growing risk. They decided to limit trading.

Almost immediately, GameStop’s shares plunged, falling 75 percent in 90 minutes, causing outrage among RobinHood’s customers who suggest the app is more interested in protecting rich Wall Streeters than their name suggests.

Meanwhile the trading forced Robinhood to raise more than $1 billion from its existing investors, most likely because it needs more cash to cover heightened margin requirements. Then Robinhood relaxed restrictions on the GamesStop stock and its price rose again.

How does this end? No one knows. But some analysts say the intense activity could lead to contagion – forcing hedge funds on the losing side of these trades to sell parts of their portfolios to raise cash to cover their losses.

What does it all mean? Politicians are already struggling to come to terms with what looks like a populist revolt against Wall Street.

But for now, many are just quoting an old Wall Street saying: “the bigger the balloon, the louder the pop.” The question is who will be left holding the bag when GameStop’s stock eventually comes crashing?

Posted in: Infographic of the day | Leave a CommentIs WeWork OVER?

Co-working giant WeWork is on the ropes. Is it finished?

Despite expansion in 2019, making global revenues almost double from $1.8bn to $3.5bn, the business also saw losses balloon by 129 per cent – which meant losses grew at a faster rate than WeWork’s income.

In the UK, for example, rental income almost doubled from £35.8 million to £68.4m. But losses in 2019 more than tripled to £231.7m.

The growth was built on WeWork signing long, expensive leases on space it rented out in a multitude of short-term deals. In so doing the company exposed itself to what insiders call a “near-ruinous” level of risk.

When Covid-19 struck, WeWork’s total membership fell by 11 per cent in the third quarter of 2020 alone.

Right now things look grim, but if WeWork is able to hold on through the crisis, it could see demand peak again as companies search for flexible spaces to accommodate a hybrid workforce.

The clock is ticking. SoftBank, who already owe 80% of WeWork stock, pulled out of an agreement to buy $3bn of WeWork shares from early investors including Neumann – a decision that has ended up in court.

If Soft Bank’s patience has reached its limits, WeWork’s could be toast.

Posted in: Infographic of the day | Leave a CommentRobinhood is disrupting investing but NOT IN A GOOD WAY

Robinhood, an app that allows users to trade stocks largely commission free, was recently fined by the SEC for not being transparent about how they monetize their consumer’s data.

The fine? Just $2m Robinhood’s valuation? $11.2 bn.

Like Facebook, Robinhood does not think of its investors as customers but rather as products whose data can be sold to the highest bidder.

Robinhood sells data on trades its investors make to other hedge funds who front run these trades or use it to glean insight about what the dumb money is doing.

Robinhood traders also trade 88 times more options than competitors.

“Options” are exotic financial instruments that are not for novice investors. Most of Robinhood’s investors are young men simply do not understand the complexities of some Wall Street trades.

When Robinhood had an outage recently volatility sky-rocketed and volume went way down. Like Uber and Facebook, Robinhood are a tech firm that are disruptive in their markets in a way that often does more harm than good.

Posted in: Infographic of the day | Leave a CommentBig Tech has taken Hollywood and FEATURIZED IT

Once upon a time, in order to be successful, movie moguls had to ensure that their new movies turned a profit.

Those days are officially over.

Now movies have been “featurized” – they are now simply a way to feature or differentiate another, better business – Big Tech.

If Amazon signs up more Prime Memberships because of a movie or Podcast offer, or even if they just reduce customer churn a couple percentage points, then the cost of making that movie of Podcast has been worth it. Who cares if one movie turns a profit on its own?

The ultimate example of this trend right now is podcasting. People are very fond and have good will towards their favourite podcasts but the industry is so small it has not been effectively monetized.

Spotify recently bought the US’s number one podcast – the Joe Rogan Experience. By making the Podcast available on their platform, Spotify has entered the content game, just as Netflix did when they produced House of Cards. The effect on both firms stock price was profound – Spotify has seen their stock rise 126% as a result.

Even at $100m, content is still the cheapest way for Big Tech to differentiate its platforms.

Posted in: Infographic of the day | Leave a CommentHouse prices surge as demand for offices and gyms FALL OFF A CLIFF

We used to spend 17% of our budget on commuting, but Covid has made commuting impossible.

We used to spend 17% of our budget on commuting, but Covid has made commuting impossible.

What will we do with that money? We will spend it on our homes – the place where we live, eat, sleep and now work.

What does this mean? Demand for office space is getting destroyed while residential demand is booming – along with all the brands that can feather your family’s nest.

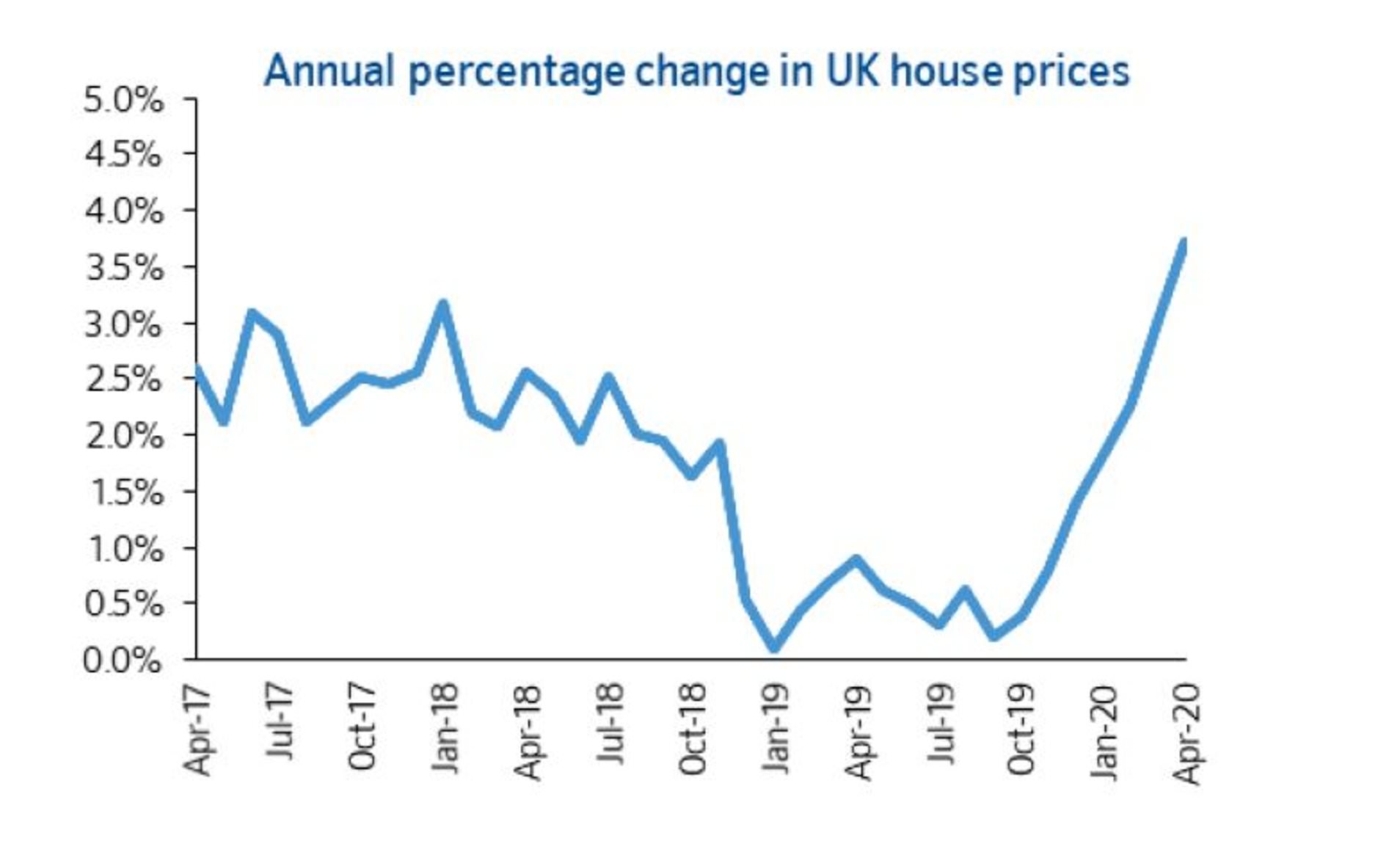

UK house prices increased by 4.7% in the year to September 2020, up from 3.0% in August 2020.

As it is with offices, so it is with gyms. Demand for gyms is tanking by up to 10-30%. Home exercise equipment is one the rise.

Posted in: Infographic of the day | Leave a CommentFor big tech, it’s the beginning of THE END

The EU and the US have begun to push back against the power of Big Tech.

They both want a new alliance on how to regulate Big Tech and tax digital trade. The plan is to create new rules of the road for the 21st Century economy.

Citing anti-trust concerns, a recent US government lawsuit has demanded Facebook spin out WhatsApp and Instagram – the social media platforms Facebook bought to choke off competition.

This spells the beginning of the end of the period dominated by Big Tech’s four behemoths – Facebook, Apple, Google and Amazon. Their free pass is being revoked.

The move is overdue. US markets are less competitive than at any time since the days of the Robber Barons.

From 1997 -2012, two thirds of US industries registered an increase in concentration – meaning that the big guys got bigger and the small guys perished.

A side effect was that the number of start-ups as a percentage of all firms fell by 50% between 1979 and 2014.

That’s no surprise. Start ups don’t thrive when the big players will not provide them with any oxygen.

Today, Google controls almost 90% of the global search market. Forty cents in every dollar of business’s new funding goes to Facebook, Google or Amazon. And the accelerant of Covid is enhancing their dominance

One firm could get out ahead of any government action. Insiders believe Amazon will spin off AWS by 2021.

If that happens it’s likely AWS could become the world’s most valuable firm by 2025.

Posted in: Infographic of the day | Leave a Comment