Here are some numbers for you.

Seven months: how long it took Alibaba to be China’s largest seller of money market funds.

18 months: how long it took Google to erase 85 percent of the market capitalization of the top GPS companies after launching its mobile maps app.

Three years: the length of time it took Alibaba, China’s equivalent to Amazon, to become a $16billion lender.

Five years: how long it took Apple to become America’s largest music retailer.

Seven years: how long it took Apple to be the largest in the world.

60%: the percentage of executives who said their company intends to venture into other industries for growth in the next five years via alliances, joint ventures and acquisitions.

50%: the percentage of growth and profits of developed banks compared to pre-crisis levels.

1/3: the fraction of traditional bank revenue eroded by competition from non banks by 2020, according to Accenture.

1/3: the fraction of domestic Starbucks revenues paid through its own loyalty cards.

Here’s another list to make bankers toes curl. This time it’s brands that are venturing into the banks core areas such as checking and savings:

- Google: they’ve created a plastic debit card for Google Wallet

- T-Mobile : they’ve developed a new checking service with a smartphone App and ATM card

- Walmart: they’ve teamed with American Express to launch a prepaid card that functions like a debit account. They boast over one million customers.

These companies have a long way to go to compete against banks product-for-product and service-for-service, and many believe that regulatory barriers will dampen disruption. But new entrants are raising service expectations and creating distance between banks and their customers.

This is bad news for traditional banks.

The big risk: new competitors will consign them to a limited role as back-office utilities while non-banks become the new face of their customer’s financial lives.

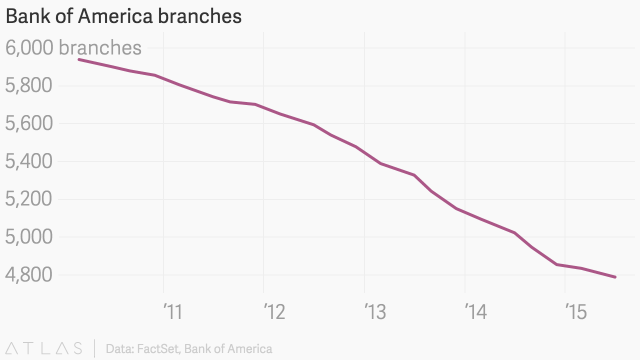

Banks cannot respond to these threats by “being more digital” – closing down branches, tolling out better mobile and online banking services.

To defend their turf against Google and PayPals they themselves must move further into the commercial lives of their customers.

They must learn to play a greater role not just at the moment of financial transactions but before and afterwards as well.

Banks have some big advantages, especially digitally: large customer bases, lots of transaction and customer data, capabilities to enable payments, security and financing – all of which are hard to copy.

Banks should combine vast transaction data with new digital tools to help customers make decisions on what to buy, where and when to buy it – dinner, a movie or even a new home.

Some already are. Here are some examples.

- Garanti, one of Turkey’s largest banks, offers a free mobile app that gives customers personalized offers and advice based on their location and past spending. It uses GPS and Foursquare to tell them if they are close to a store with a special offer, provides saving suggestions, and estimates how much customers will have in their account for the rest of the month based on past spending.

- Bank of America analyzes transaction data to give customers cash back on transactions at frequently used merchants. Customers click a button below a previous transaction on their online statement to accept an offer. The next time they shop at that merchant, cash is automatically added to their bank account. The bank has given $17 million in cash back to customers using Cardlytics technology.

- Commonwealth Bank of Australia offers a mobile app that uses “augmented reality” technology to help with home-buying. House hunters simply point their smartphone camera at a residence to bring up extensive property detail, alongside monthly payment estimates on mortgages and insurance. The app covers 95 percent of all residential properties in Australia and generates 20,000 property searches per week.

- BBVA has long made available to its US customers information on the actual selling price of cars (as opposed to list prices) based on TrueCar data to give them an advantage in their car negotiations, while promoting their auto loans and insurance. The bank’s innovation lab has envisioned even going a step further in other countries and providing auto specialists armed with such data to negotiate directly with car sellers on their customers’ behalf.

As the lines between industry sectors blur all around, financial services will take on new meaning in the minds of consumers – and perhaps very quickly.

To be a profitable sector, banks cannot simply rely on providing accounts and access to funds. The future of the sector will depend on its ability to provide services that help customers save and better manage money in their everyday lives. That’s what’s next for banks.

Posted in: What's next for banks | Leave a Comment