The six reasons Deutsche Bank’s CEOs just got whacked

So why are Anshu Jain and Jürgen Fitschen stepping aside as co-CEOs of Deutsche Bank, making way for former UBS finance chief John Cryan can take over?

Since the duo took over in 2012, the bank has drifted. Here’s how:

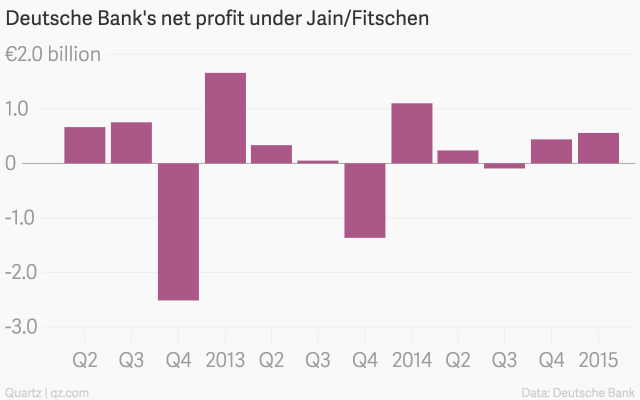

1. It didn’t make much profit

During the CEOs tenure, the bank made $2billion. Sounds like a lot. UBS made $5billion during the same period.

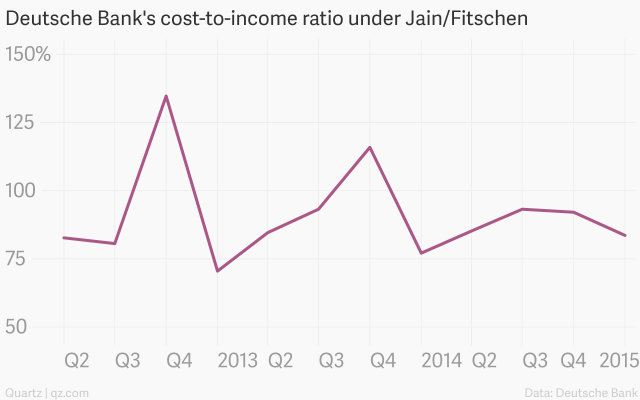

2. It didn’t cut costs

DB has had no shortage of strategy: ”Strategy 2015+“, “Strategy 2020“. Each planned to cut costs. But it’s the oldest story in the book: the problem ain’t strategy but execution. DB has failed to bring its cost-to-income ratio below its target ceiling of 65%.

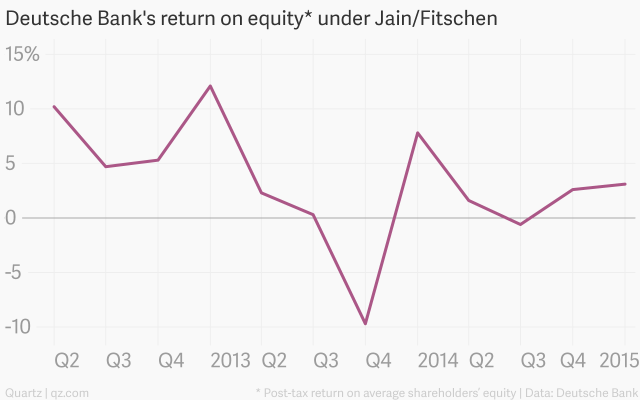

3. It couldn’t get much return on its equity

Shortly after taking over, Jain and Fitschen announced a goal to reach a ratio of 12% by 2015. This has since been cut to 10%, but even that looks a tall order given recent history.

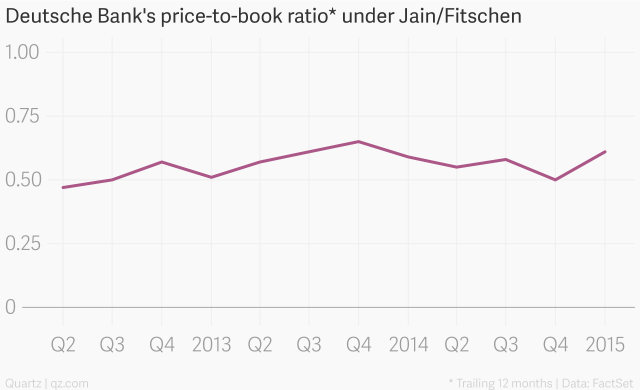

4. Shareholders didn’t like it

Its market value has consistently traded at a fairly hefty discount to the book value of its assets.

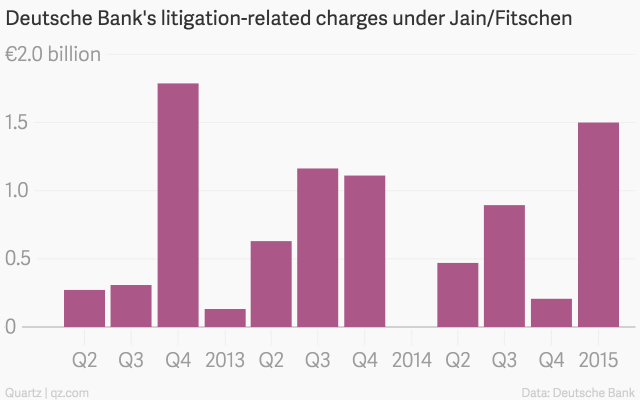

5. It got sued a lot

Business website Quartz dubbed Deutsche “a legal defense fund with a bank attached.” As well more than €8 billion in litigation-related charges under Jain and Fitschen, the bank still faces potential payouts for allegations of misdeeds in foreign-exchange trading, money laundering, and several other areas.

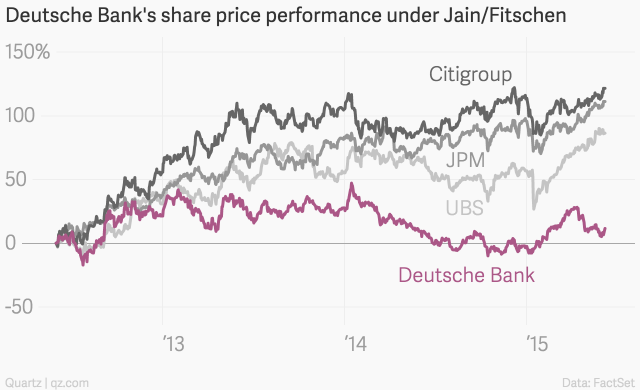

6. Its stock price was flat

What’s next for Deutsche

Ex UBS finance chief John Cryan, DB’s new CEO, is a hard nosed dude who is determined to execute strategy (namely, cutting costs).

He cleaned up UBS, perhaps he can do the same for Deutsche. Then again. perhaps he can’t. This statement from DB just hit the wires:

Today the offices of Deutsche Bank in Frankfurt are being searched by the Public Prosecutor’s Office. The search relates to an investigation into securities transactions by clients. Employees of Deutsche Bank are not accused of any wrongdoing.

Posted in: What's next for banks