Recent inflation won’t drive up interest rates. The reason is “demographic stagnation”

As we pull out of lockdown and the pandemic subsides, some economists have started to turn their attention to a new risk – inflation.

With lockdown over, pent up demand has been released but suppliers have been caught on the hop. The result is more demand than supply, rising prices and a bulge in inflation.

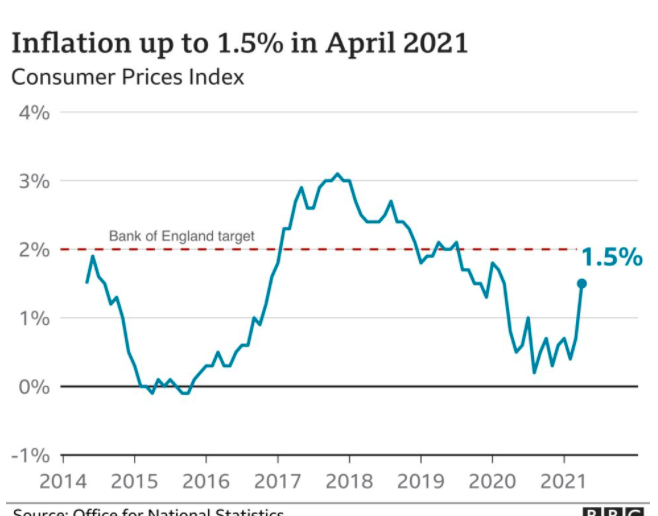

The annual UK inflation rate more than doubled in April. What manufacturers pay for raw materials has risen 9.9%.

Recently the US Bureau of Labor Statistics reported much higher inflation than almost anyone predicted.

With spiralling inflation comes rising interest rates. So will the Bank of England raise interest rates to cool an overheating economy? No

One reason is that today’s inflation rates are just a blip reflecting what are probably one-time rises in the prices of building materials and used cars.

Once the pandemic subsides, we will likely again find ourselves in an environment of sustained low interest rates as a result of low investment demand. And the reason for that is plunging fertility.

Last month’s census report showed the lowest U.S. population growth since the 1930s.

- Japan’s working-age population has been declining since the mid-1990s.

- The euro area has been on the downslope since 2009.

- Even China is starting to look like Japan, a legacy of its one-child policy.

We are in a flat population economy. Under normal circumstances investment demand is driven by population growth, as new families need newly built houses, new workers require the construction of new factories, and so on.

Secular stagnation

But low population growth can cause persistent weakness in spending. This phenomenon is called “secular stagnation.”

The downside of persistent low interest rates for the economy is that if there is a recession, the Bank of England is not in a position to slash rates to stimulate growth as rates are so low already.

One way out is for governments to take advantage of those same low interest rates to borrow money to fund public works and rebuild crumbling infrastucture, stimulate the economy and encourage investment.

Related stories

7 benefits of data visualization storytelling

House prices surge as demand for offices and gyms FALL OFF A CLIFF

About the author

My name is Andy Pemberton. I am an expert in data visualization. I guide global clients such as Lombard Odier, the European Commission and Cisco on the best way to use data visualization and then produce it for them: reports, infographics and motion graphics. If you need your data visualized contact me at andy@furthr.co.uk or call 07963 020 103

Posted in: Infographic of the day