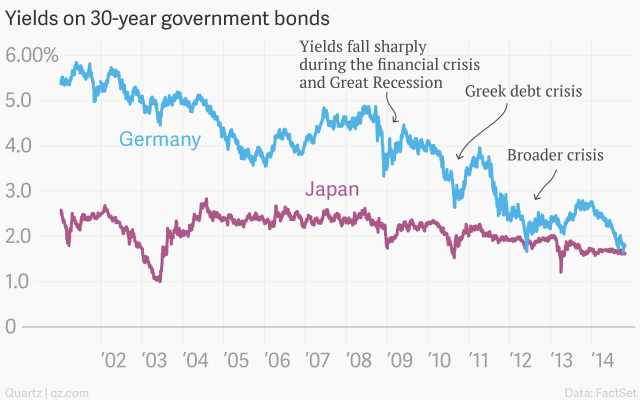

Europe is turning Japanese. I really think so

October 31, 2014

Today, the Bank of Japan announced an expansion of its aggressive monetary policy (printing money) to banish “deflationary mindset.” Should Europe do they same? (Clue: yes). Rising risks of deflation in Europe have been driving German bond yields (the Euro safety benchmark) down, so now they converge with those of Japan, which has been trying to win a decades-long battle with falling prices. Stay tuned, because this Euro deflation show could run and run. (Explainer: The yield of a bond is inverse to its price: as bond (loan) prices increase, bond yield (interest) falls.)

Posted in: Infographic of the day