Active fund managers are useless, say investors

Managed funds need to up their game. They aren’t doing enough to prove they are worth their excessive fees.

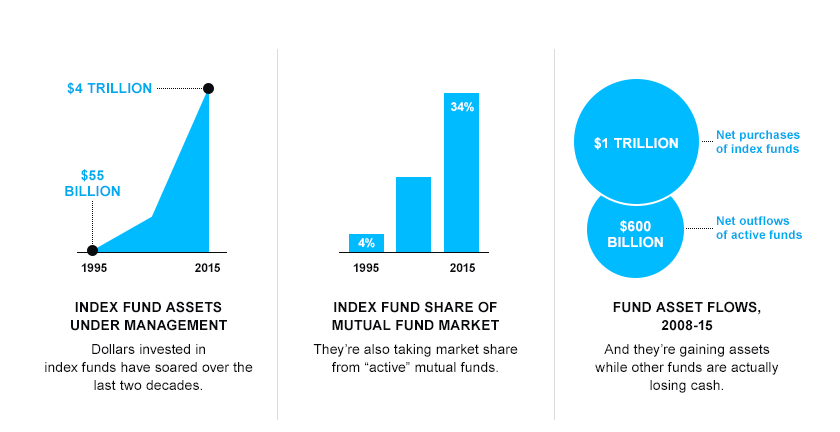

As these charts show, more investors are pulling their money out of actively managed funds (average expenses: about 0.8% of assets annually) in favour of ETFs and index funds (average expenses: about 0.2%) that keep costs down by simply mimicking the markets.

Meanwhile, a growing body of research suggests that very few of the pricier active funds outperform the indexers over the long term.

Active fund managers have often argued that they’re particularly good at beating the broader market (or at least at losing less money than the broader market) when stocks are falling, as they are now.

And active funds did outperform index funds in 2016, losing 2.2% on average while the average indexer lost 2.7%, according to Morningstar.

But fewer customers are sticking around to see if the managers can keep that streak alive in 2016.

I’m interested in making beautiful and effective infographics with Furthr

Posted in: Infographic of the day